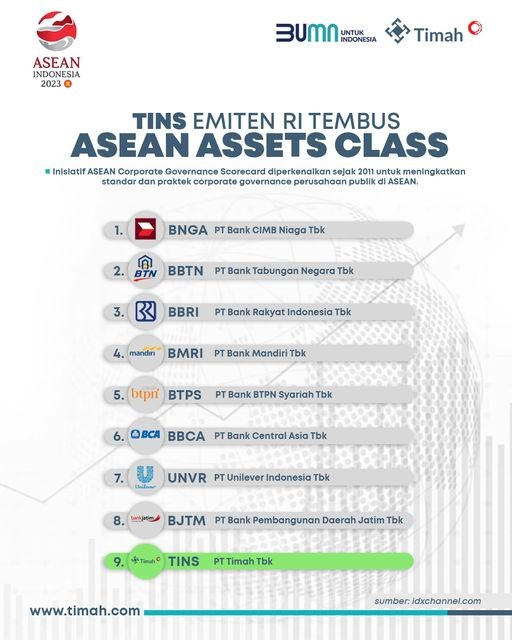

JAKARTA -- PT Timah Tbk (TINS) is one of nine listed companies in Indonesia that are included in the ASEAN Asset Class PLCs category. The list is the result of the 2021 ASEAN Corporate Governance Scorecard (ACGS) assessment.

Listed Companies in Indonesia that are included in the ASEAN Asset Class PLCs category are considered to have good corporate governance and deserve the attention of global investors.

This announcement was made by the Indonesian Stock Exchange at the Launching of the 2023-2027 Indonesian Capital Market Roadmap and Appreciation of the 2021 ACGS Assessment Results, Tuesday (31/1/2023).

The ASEAN Corporate Governance Scorecard (ACGS) is one of the assessments of Corporate Governance by using a benchmark or parameter for measuring Corporate Governance practices agreed upon by the ASEAN Capital Market Forum (ACMF), namely the association of ASEAN capital market authorities.

Main Director of IDX, Iman Rachman said the nine companies included in the ASEAN Asset Class category, among others; PT Bank CIMB Niaga Tbk (BNGA), PT State Savings Bank (Persero) Tbk (BBTN), and PT Bank Rakyat Indonesia (Persero) Tbk (BBRI), PT Bank Mandiri (Persero) Tbk (BMRI), PT Bank BTPN Syariah Tbk (BTPS), PT Bank Central Asia Tbk (BBCA), PT Unilever Indonesia Tbk (UNVR), PT East Java Regional Development Bank Tbk (BJTM), and PT Timah Tbk (TINS).

IDX together with SROs expresses their appreciation to listed companies for all their efforts and dedication in implementing good corporate governance as seen from the results of the 2021 ACGS assessment. These efforts include directions from top management, then the formation of internal policies, disclosure of information that is comprehensive and easily accessible to the public. public so that it becomes a series of CGC implementations for listed companies in Indonesia.

"ACGS is an international event that companies in the Asean region have been waiting for. Therefore it is an honor for the Indonesian capital market to see the achievement of the first company in the Asian Top 20 Public Listed Company or PLC and nine Indonesian listed companies in ACGS that have successfully entered the shortlist in the ASEAN Asset category. Class PLC," said Faith in the Launching of the 2023-2027 Indonesian Capital Market Roadmap and Appreciation of the 2021 ACGS Assessment Results, Tuesday (31/1/2023).

Imam added, the IDX also gives appreciation to listed companies that have succeeded in achieving a high increase in ACGS scores in the Domestic Significantly Improve PLC category. With the achievement and process of ACGS 2021, IDX hopes that Indonesian-listed companies can continue to maintain their performance and implement CGC.

Second, it can improve corporate governance standards so that the quality of the company is listed as more competitive both at home and abroad. Finally, the company has received positive benefits from implementing CGC, especially in terms of increasing investor confidence.

"Hopefully the results of this assessment can be a motivation for listed companies in Indonesia to be able to continue to improve the implementation of CGC," added Iman.

Meanwhile, the Corporate Secretary of TINS, Abdullah Umar said that the Company is committed to implementing the principles of Good Corporate Governance (GCG) in the company's business governance.

In 2021, PT Timah Tbk achieved an ACGS score of 90.64. In 2022 the company is optimistic that it will get a better value in line with the company's commitment to making improvements.

"The 2022 assessment is still in progress, but the company is optimistic that this year's ACGS score will increase significantly because the company continues to be committed to making improvements and fulfilling records from the 2021 assessment results," said Abdullah.

The company, he said, also continues to boost performance to continue to maintain investor confidence and be able to make a good contribution to the state, government, and society.

"This assessment is a motivation for the company to continue to improve corporate governance and be able to maintain investor confidence so that it can have a positive impact on the state, government and society," he said. (**)